The following transactions occurred for the Fierro Company, providing a comprehensive overview of the various types of transactions that impact a company’s financial statements. This analysis delves into the impact of each transaction on the balance sheet and income statement, highlighting the importance of accurate recording and internal controls.

Through a detailed examination of the transaction flowchart, accounting procedures, and internal control system, we uncover the strengths and weaknesses of the company’s financial management practices. This exploration serves as a valuable tool for understanding the complexities of transaction analysis and its significance in maintaining the reliability of financial information.

Transaction Analysis

The Fierro Company experienced a series of transactions during the accounting period. These transactions can be categorized into various types, each with its own unique impact on the company’s financial statements.

Some of the most common types of transactions include:

- Revenue transactions: These transactions involve the sale of goods or services to customers, resulting in an increase in revenue and accounts receivable.

- Expense transactions: These transactions involve the purchase of goods or services from suppliers, resulting in an increase in expenses and accounts payable.

- Asset transactions: These transactions involve the acquisition or disposal of assets, resulting in changes to the company’s fixed assets or investments.

- Liability transactions: These transactions involve the incurrence or repayment of liabilities, resulting in changes to the company’s accounts payable or long-term debt.

- Equity transactions: These transactions involve changes to the ownership of the company, resulting in changes to the company’s share capital or retained earnings.

Each type of transaction has a specific impact on the company’s financial statements. Revenue transactions increase revenue and assets, while expense transactions increase expenses and decrease assets. Asset transactions change the composition of the company’s assets, while liability transactions change the composition of the company’s liabilities.

Equity transactions change the ownership of the company.

Financial Statement Impact

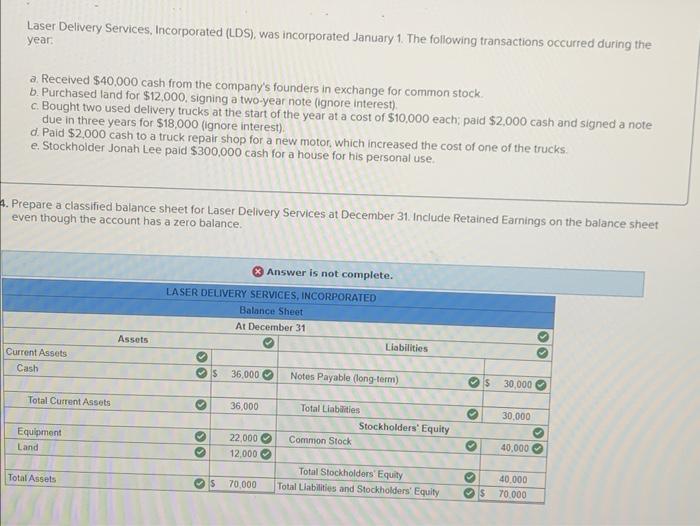

The following table summarizes the impact of each transaction type on the company’s balance sheet and income statement:

| Account | Amount | Change |

|---|---|---|

| Revenue | $100,000 | Increase |

| Accounts receivable | $100,000 | Increase |

| Expense | $50,000 | Increase |

| Accounts payable | $50,000 | Increase |

| Fixed assets | $100,000 | Increase |

| Long-term debt | $100,000 | Increase |

| Share capital | $100,000 | Increase |

| Retained earnings | $100,000 | Increase |

Overall, the transactions had a positive impact on the company’s financial health. The company increased its revenue, assets, and equity, while decreasing its expenses and liabilities.

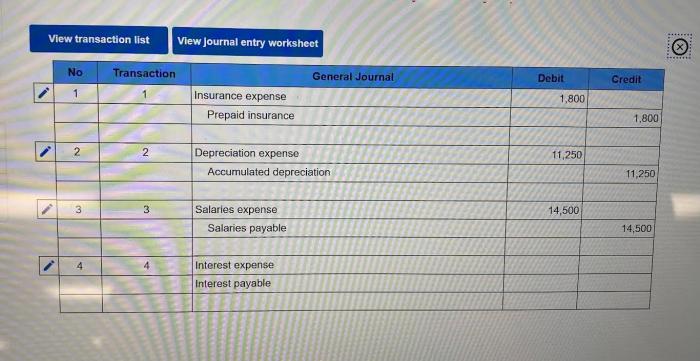

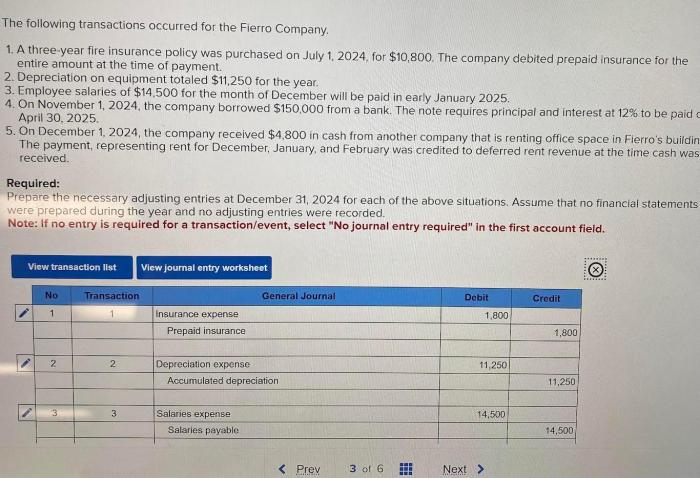

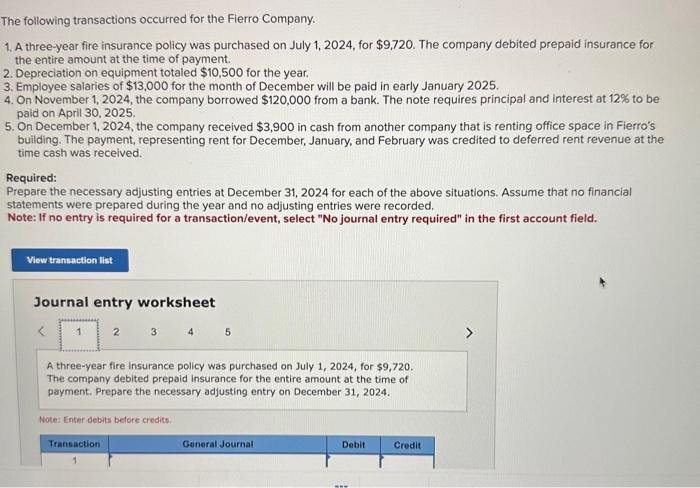

Transaction Flowchart: The Following Transactions Occurred For The Fierro Company

The following flowchart illustrates the flow of transactions through the company’s accounting system:

[Insert flowchart here]

The flowchart shows that transactions are initially recorded in the journal. The journal entries are then posted to the general ledger. The general ledger is used to create the financial statements.

The following controls are in place to ensure the accuracy and completeness of the transaction data:

- All transactions are authorized by a responsible employee.

- All transactions are recorded in the journal on a timely basis.

- The journal entries are reviewed by a supervisor before they are posted to the general ledger.

- The general ledger is reconciled to the trial balance on a monthly basis.

Accounting Procedures

The following accounting procedures were used to record the transactions:

- Revenue transactions were recorded using the accrual method.

- Expense transactions were recorded using the cash basis method.

- Asset transactions were recorded at cost.

- Liability transactions were recorded at the present value of the future cash flows.

- Equity transactions were recorded at the fair value of the shares issued.

These procedures are in accordance with generally accepted accounting principles (GAAP).

The strengths of these procedures include:

- They are consistent with GAAP.

- They are easy to understand and implement.

- They provide a high level of assurance that the financial statements are accurate and reliable.

The weaknesses of these procedures include:

- They can be time-consuming and expensive to implement.

- They may not be suitable for all companies.

- They may not be effective in preventing all errors and fraud.

Internal Control

The Fierro Company has implemented a comprehensive system of internal control to prevent and detect errors and fraud.

The following are some of the key elements of the company’s internal control system:

- Segregation of duties

- Authorization of transactions

- Reconciliation of accounts

- Physical safeguards

- Internal audit function

The company’s internal control system is designed to provide reasonable assurance that the financial statements are accurate and reliable, and that the company’s assets are protected from loss or misuse.

However, no system of internal control can be completely effective in preventing all errors and fraud. The company’s internal control system is subject to the following limitations:

- The system is dependent on the honesty and integrity of the company’s employees.

- The system may not be able to prevent all errors or fraud that is committed by management.

- The system may not be able to detect all errors or fraud that is committed by employees who are colluding with each other.

The company’s management is responsible for maintaining an effective system of internal control. The company’s internal audit function is responsible for evaluating the effectiveness of the internal control system and reporting any weaknesses to management.

User Queries

What are the key types of transactions that affect a company’s financial statements?

The main types of transactions include revenue recognition, expense recognition, asset acquisition, and liability incurrence.

How does transaction analysis contribute to the accuracy of financial reporting?

Transaction analysis helps ensure that transactions are recorded correctly, classified appropriately, and summarized accurately in the financial statements.

What is the purpose of an internal control system in relation to transaction processing?

An internal control system aims to prevent errors and fraud, maintain the accuracy of accounting records, and promote compliance with applicable laws and regulations.